Day change 101: Your Best Self-help guide to Quick-Label Deals

It argue that, more often than not, the brand new prize doesn’t validate the chance. Obviously, date trading and alternatives exchange are not collectively personal. Of numerous people merge parts of both, such as date trade alternatives otherwise playing with choices to hedge go out trading positions. But not, this involves a premier number of elegance and you will understanding of both change appearances. Including, state 24 hours investor has completed a technological study out of an excellent team called User-friendly Sciences Inc. (ISI). The study demonstrates that that it inventory, listed in the fresh Nasdaq a hundred, reveals a cycle from speed increase by the at the least 0.6% of all weeks in the event the Nasdaq is up more 0.4%.

Monetary Segments: A great Beginner’s Review – immediateevex pro

Whilst it could possibly offer high payouts and you will immediateevex pro freedom for most, it’s large-exposure, time-ingesting, rather than right for group. It is estimated that a lot of go out traders never money, proving the need for careful consideration and you can thinking. And expertise in actions, go out buyers need to keep up with the brand new stock exchange information and you will events that affect brings.

Which are the Popular Dangers New-day Traders Is always to Avoid?

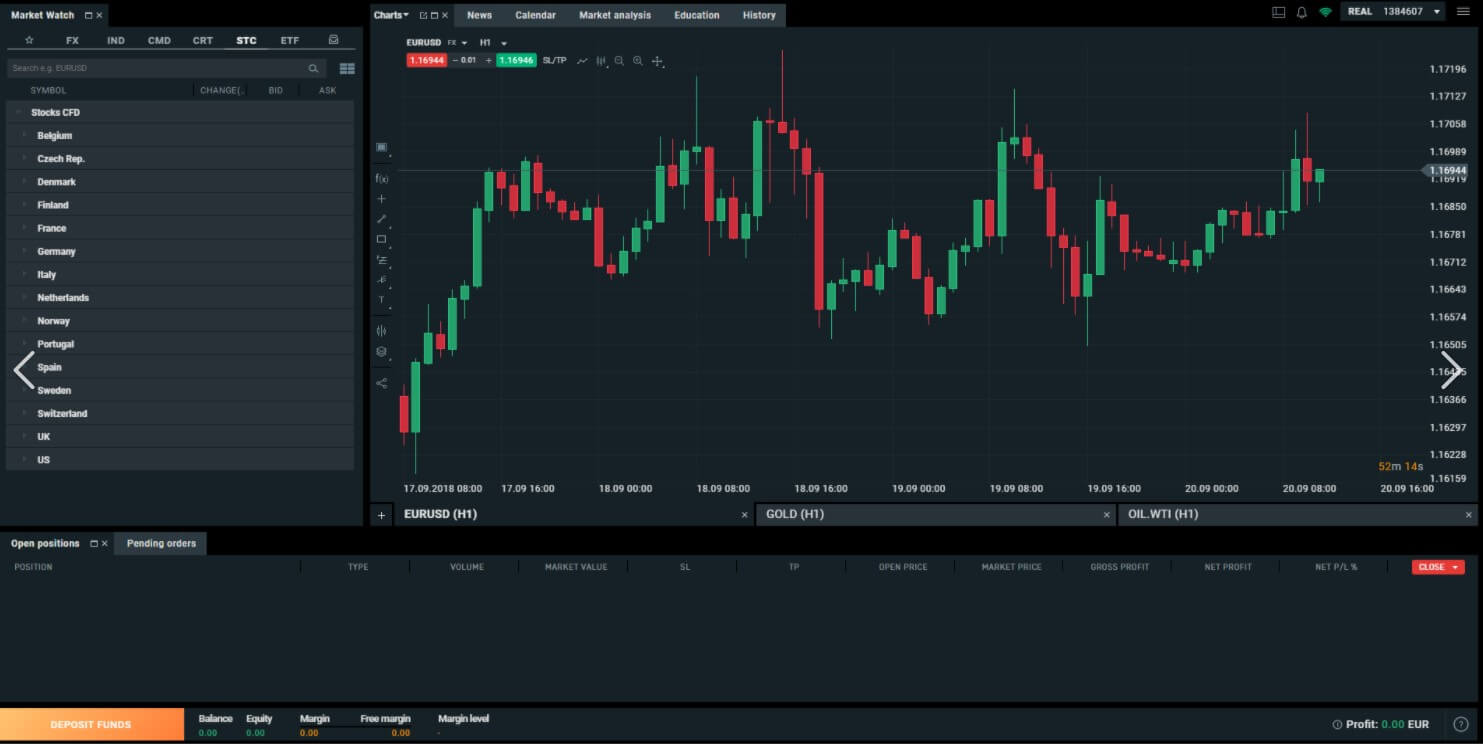

Should your means exposes you to definitely too much risk, you should change it somehow to attenuate the fresh exposure. It’s best if you place a max losses daily you are able to afford. When you hit this aspect, log off the trading or take the rest of the date from. Once you’ve particular entry laws and regulations, test far more charts to see if the conditions is actually made every day. Such as, see whether a good candlestick chart development indicators rates actions in the guidance you expect. Determine what sort of sales you will employ to get in and you will get off positions.

Should your CRA considers your an expert time trader, 100% of development are taxed while the business earnings. To make sure you’lso are maybe not happen to stiffing the new CRA, you will want to request a tax top-notch to find out just how your own exchange points is going to be categorized. As the 24 hours individual, the economic diary is one of your very best members of the family. You will simply spend a second inside it day (or smaller), however, this package second—every day—is crucial if you want to avoid the risk because of high-impression research/information launches. Volatility within the knowledge is common and expected, no matter whether the data is released a lot more than, lower than, otherwise inside range which have business criterion.

Plans is walking change margin requirements, raising minimal trade amounts, and you will decreasing the number of deals expiring each week. Financial places are primarily regulated because of the Bonds and you will Replace Panel of Asia (SEBI), that has been created in 1988. The fresh NSE in addition to facilitates types trading to your offers, equity indices, fx, merchandise and rates. Investors can also be replace repaired-income items like authorities and business bonds also. An absolute need (in our opinion) will be the representative try managed. Your wear’t need to use a managed broker, but we, and most anyone else in the industry manage recommend they.

As to the reasons Investors Fail in the Finding Market Signals the proper way

Direct field availableness allows traders to send the requests directly to certain exchanges such Nasdaq, ARCA and you can BATS. This allows smaller order performance, that is naturally better to have time people. As opposed to really shopping brokers where $0 income try fundamental, agents giving lead field availableness normally fees income.

This permits you to get a be for the business instead of risking high damage to the investment. Consider it since the dipping your feet in the water just before dive inside. It will help you understand its subtleties instead spreading yourself too narrow. You can grow after, however, learning one area very first is a smart disperse.

As long as you features financing on the membership, the brand new representative enables you to make use of the visibility permitted to shelter the positions. The fresh Monetary Globe Regulating Power – FIRA manages and you may kits laws to own go out trading. If the funding principal is perfectly up to $25k, you will want to follow the time trading laws to prevent regulatory items. Day trader can make a few hundred positions in the a great date, with respect to the approach and just how apparently attractive possibilities appear.

- To succeed in time change, traders need to have a benefit across the field.

- Most importantly, you must know the newest heightened dangers doing work in go out trade.

- In case your technique is inside your risk limitation, then evaluation begins.

- It’s critically vital that you see the risks involved in time exchange, do all of the chance you are exposed to, and get happy to undertake losings.

- The economical schedule will bring day traders that have an obvious report on the secret monetary dates and announcements to the trading example, demonstrated within the a table style.

Our very own writers provides collectively place a huge number of trades over the work. As previously mentioned more than, day trade since the employment will be difficult and extremely tough. Extremely people notice a good destruction within the results once they option away from demo trade to reside change. You can even see it difficult to get back into the fresh business community.

Encompassing me personally that have for example-inclined people might have been indispensable during my day exchange journey. I’ve joined trading groups, each other online and within the-person, where I could display feel, talk about tips, and you can seek advice. Which circle provides mental support through the challenging minutes and you can honors achievements with her. Which have a guide was also very important, giving guidance and you may enabling me personally end well-known dangers. Although not, stock trading has pattern go out investor (PDT) regulations, requiring at least balance away from $twenty-five,000 to possess frequent trading. Mental manage is perhaps the most difficult expertise to learn inside the day trading.

The newest commodities market works with the fresh change away from recycleables and number 1 products like harsh oils, precious metals, and you can farming points. Traders have access to this market due to futures agreements otherwise replace-replaced finance (ETFs). Some other good choice is actually AvaTrade, which has an amateur-amicable app along with a keen academy intended for novice buyers. Obviously, nobody is protected to pressure and clear field activity will likely be stressful. If you’lso are trying to find carries, specialize in a particular world, for example renewable power, or even a specific company or a couple, for example JP Morgan. Here, the target is to pick when trading volumes will start to decrease.

If you are a carries individual, local plumber occurs when the market industry are opening otherwise when its about to close. Most of the time, as the a normal time investor, you will not have access to the marketplace producers. For example, after you unlock a swap with Robinhood, you wear’t reach purchase the market maker who’ll perform the fresh trade. With this means, your open a merchant account, understand exchange steps (or develop your own), put money, and then perform their investments. You want adequate set aside otherwise arriving you don’t need to bother about exactly what’s on your own trade membership.