Professional Guidelines for Forex Trading Frameworks Leave a comment

Forex trading is a sophisticated endeavor that requires a well-structured framework for success. A comprehensive forex trading framework is not just about having the right tools or strategies; it involves understanding the market dynamics, risk management, technical analysis, and psychological aspects of trading. In this article, we will delve into the essential aspects of building a professional forex trading framework, providing guidelines that can help both novice and experienced traders enhance their trading performance. For more insights and resources, visit forex trading framework professional guidelines forex-level.com.

1. Understanding the Forex Market

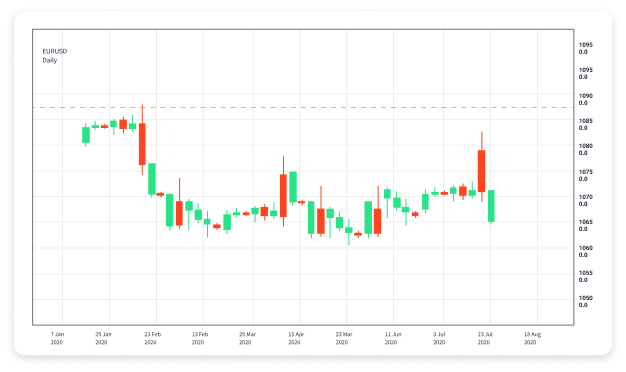

The foreign exchange market, or forex, is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. To succeed in forex trading, it is crucial to understand various components such as currency pairs, market hours, and economic indicators. Currency pairs are categorized into major, minor, and exotic pairs, each presenting different trading opportunities. Major pairs, such as EUR/USD and USD/JPY, have the highest liquidity and lower spreads, making them ideal for beginners.

1.1 Market Hours and Liquidity

The forex market operates 24 hours a day, five days a week, segmented into three main sessions: the Asian, European, and North American sessions. Understanding these sessions helps traders identify peak trading times, which coincide with high liquidity and volatility. A well-structured trade plan should consider these factors to enhance market entry and exit opportunities.

2. Developing a Trading Strategy

A solid trading strategy serves as the backbone of any successful forex framework. This strategy should encompass various methodologies, including technical analysis, fundamental analysis, and sentiment analysis. Each trader may choose to focus on a specific approach or combine multiple methods to suit their trading style.

2.1 Technical Analysis

Technical analysis involves studying historical price charts to identify patterns, trends, and key levels of support and resistance. Traders often use various indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to aid their decision-making. It is vital to remember that no single indicator should dictate your trading decisions; instead, a combination of tools can provide more reliable signals.

2.2 Fundamental Analysis

Fundamental analysis focuses on economic indicators, interest rates, and geopolitical events that can affect currency valuations. Understanding how these factors influence the forex market is essential for making informed trading decisions. Key reports such as Non-Farm Payrolls, Consumer Price Index, and Gross Domestic Product will provide insights into market trends and potential price movements.

2.3 Sentiment Analysis

Sentiment analysis gauges the general mood of the market participants. This can involve examining news releases, trader positions, and overall market sentiment. Tools such as the Commitment of Traders (COT) report can provide insights into how institutional traders are positioned, helping you to align your trading strategy with market sentiment.

3. Risk Management Principles

Effective risk management is a critical component of any forex trading framework. It involves identifying and mitigating potential losses to protect your capital. Here are some key components of a robust risk management strategy:

3.1 Position Sizing

Proper position sizing ensures that you do not risk more than a predetermined percentage of your trading capital on a single trade. Many successful traders recommend risking no more than 1-2% of your account balance on any given trade. This approach allows you to withstand a series of losing trades without depleting your account.

3.2 Setting Stop Losses

Stop-loss orders are essential in protecting your capital from significant losses. Setting stop-loss levels based on technical analysis, such as below key support levels or above resistance levels, can help safeguard your trades while allowing for some price fluctuations.

3.3 Reward-to-Risk Ratio

Establishing a favorable reward-to-risk ratio is crucial for long-term trading success. A common guideline is to aim for a 2:1 or 3:1 reward-to-risk ratio, meaning that for every dollar risked, you aim to make two or three dollars in profit. This approach increases the probability of turning a profit, even if you have a lower win rate.

4. The Psychological Aspect of Trading

The psychological aspects of trading can significantly impact your performance. Emotions like fear and greed can lead to irrational decisions, which may jeopardize your trading success. Here are some strategies to manage trading psychology:

4.1 Developing a Trading Routine

Having a consistent trading routine can help mitigate emotional responses. This includes setting specific trading hours, preparing for market analysis, and creating a structured plan for entering and exiting trades. A well-defined routine promotes discipline and reduces impulsive decision-making.

4.2 Keeping a Trading Journal

Maintaining a trading journal allows you to document your trades, thought processes, and emotions during each trade. Regularly reviewing your journal helps identify patterns in your trading behavior, allowing you to learn from your mistakes and improve your strategy.

4.3 Practicing Mindfulness

Mindfulness techniques, such as meditation and deep breathing, can help you stay focused and calm during trading sessions. Developing a positive mindset will enable you to approach trading with clarity and rationality.

5. Continuous Learning and Adaptation

The forex market is constantly evolving, and successful traders must commit to continuous learning. Regularly updating your knowledge, understanding new financial instruments, and adapting your strategies based on market conditions are crucial for long-term success.

5.1 Staying Informed

Following financial news, subscribing to trading blogs, and participating in webinars can help you stay updated on market trends. Continuous education will empower you to make well-informed trading decisions.

5.2 Backtesting and Refining Strategies

Backtesting your strategies using historical data can provide valuable insights into their effectiveness. Analyze the results to identify areas for improvement and refine your approach, ensuring you stay relevant in a constantly shifting market.

Conclusion

In conclusion, establishing a successful forex trading framework requires a comprehensive understanding of market dynamics, a well-defined trading strategy, robust risk management principles, and an awareness of psychological influences. By adhering to these professional guidelines, traders can enhance their chances of success in the competitive world of forex trading. Continuous education, discipline, and adaptability are vital for achieving long-term profitability. Remember, the journey in forex trading is a marathon, not a sprint; patience and perseverance will ultimately lead to success.