The Crucial Role of Psychology in Forex Trading 1626903157 Leave a comment

Understanding Forex Trading Psychology

Trading in the Forex market is not solely about understanding charts and indicators; a significant factor that influences trading success is psychology. As traders engage in buying and selling currencies, their emotions and mental states play a pivotal role in decision-making, which can affect not just profits but also an individual’s overall experience in the trading landscape. It’s essential for traders to grasp the importance of psychological factors, and how mastering these can lead to more consistent performance. To support your trading journey, consider exploring forex trading psychology Top MT4 Trading Apps that can aid in your analysis and strategy formulation.

The Impact of Emotion on Trading Decisions

Emotions such as fear and greed are ubiquitous in the world of Forex trading. They can lead to premature exits from trades, over-leveraging, or even holding onto losing positions for too long. Understanding how these emotions manifest is the first step to overcoming them. Fear, for instance, can cause a trader to hesitate or second-guess their analysis, while greed can prompt reckless decisions made in pursuit of higher returns.

Common Psychological Traps in Forex Trading

Several psychological traps frequently ensnare traders. These traps include:

- Overconfidence: After a few successful trades, traders may develop an inflated sense of their abilities, leading to increased risk-taking.

- Loss Aversion: The tendency to fear losses more than to appreciate gains can result in holding onto losing positions longer than advisable.

- Chasing Losses: Some traders may resort to revenge trading, attempting to quickly recoup losses by taking larger or riskier positions.

- Confirmation Bias: This occurs when traders only seek information that confirms their existing beliefs, disregarding contrary evidence.

Building a Strong Trading Mindset

Developing a robust trading mindset involves self-awareness and strategic practices. Here are several strategies to cultivate a winning psychological approach:

- Set Clear Goals: Establish both short-term and long-term trading goals. Clear objectives provide direction and can help manage emotions during trading.

- Create a Trading Plan: A comprehensive trading plan outlines entry and exit strategies, risk management rules, and conditions under which trades will be made. Adhering to this plan can help reduce impulsive decisions.

- Practice Mindfulness: Techniques such as meditation, deep breathing, or visualization can enhance focus and mitigate stress while trading.

- Keep a Trading Journal: Documenting trades, emotions, and thought processes allows traders to analyze patterns and learn from both successes and mistakes.

The Role of Discipline and Patience

Discipline shapes a successful trading mindset. It involves following your trading plan diligently and not succumbing to the pressures of the market. Patience is equally important; waiting for the right setup and not rushing into trades can significantly improve outcomes. Remember, Forex trading isn’t a sprint; it’s a marathon that rewards those who can endure periods of uncertainty and volatility.

Utilizing Trading Tools and Resources

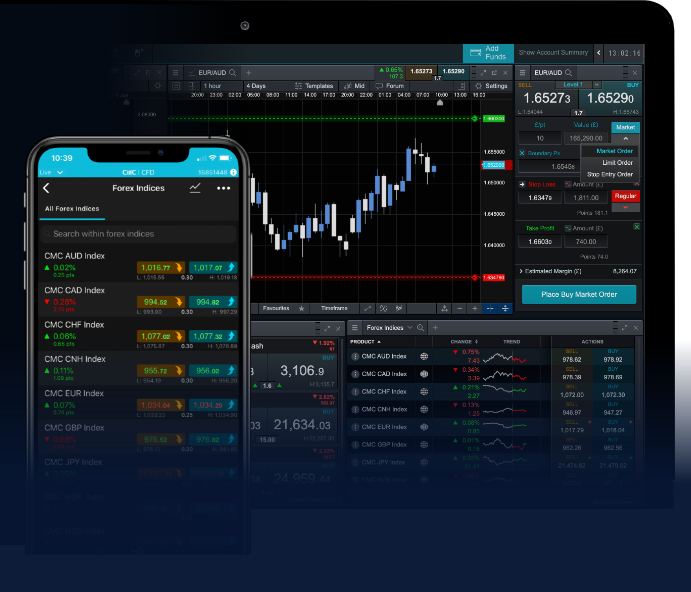

Leveraging technology can alleviate some psychological burdens. For instance, analytical tools can provide valuable insights and help make objective decisions rather than emotionally driven ones. Additionally, using demo accounts can allow traders to practice strategies without the stress of losing real money.

Seeking Support and Community

Engaging with a community of fellow traders can provide support and shared experiences. Discussion forums, social trading networks, or local trading groups can offer valuable insights and camaraderie. Sharing experiences can normalize the emotional ups and downs of trading, fostering resilience.

Conclusion

The psychological aspects of Forex trading cannot be underestimated. By acknowledging and addressing emotional responses and mental barriers, traders can enhance their decision-making processes and overall trading performance. Incorporating discipline, planning, and mindfulness into one’s trading approach enhances your chances of success in this challenging but rewarding market.